Abstract

This paper examines the likely growth trajectory of India’s artificial intelligence (AI) industry through 2030. It synthesizes recent policy moves (notably the IndiaAI Mission), market sizing studies, investment trends, talent dynamics, and sectoral demand to build three scenarios—Base Case, Accelerated Adoption, and India-as-a-Service Hub 2.0. We estimate India’s AI market could plausibly reach USD 28–35 billion by 2030 in the Base Case, USD 45–55 billion in Accelerated Adoption, and USD 60–70 billion in the Hub 2.0 scenario, with cumulative GDP contribution from AI-enabled productivity and exports far exceeding direct market revenues. Key levers include compute build-out, domestic demand in priority sectors, export-led AI services, and large-scale skilling.

1. Introduction

Artificial intelligence is diffusing across India’s economy in waves: analytics and ML adoption through the 2010s; platform-led digital public infrastructure (DPI) scaling in the early 2020s; and the emergence of GenAI use cases post-2023. India combines a large digital consumer base, one of the world’s deepest IT services ecosystems, and ambitious public investment in AI compute and safety frameworks. This paper translates those inputs into quantified 2030 outlooks and practical implications for policymakers, enterprises, and investors.

2. Definitions and Scope

Industry scope includes: (a) AI software and platforms (incl. GenAI), (b) AI-enabled IT/Business services (design, integration, managed services, model ops), (c) AI infrastructure services (cloud, data, compute), and (d) embedded/sector AI solutions (health, finance, retail, manufacturing, agriculture, public services). We treat direct market revenue separately from economy-wide GDP uplift (productivity, new products, trade).

3. 2024–2025 Baseline

- Policy: Launch of a national AI mission with multi-year funding and a target to build large public AI compute and safety frameworks.

- Market size: Independent studies peg India’s AI market (software+services) in the mid-to-high single-digit billions in 2024, growing ~25–35% CAGR through 2027.

- Demand signals: Indian enterprises are shifting more IT budgets to digital & AI; global clients are procuring GenAI-led modernization from Indian providers; data center/compute investments are accelerating.

4. Growth Drivers to 2030

4.1 Public investment and compute availability

- Nationwide public GPU/AI-compute buildout and investments in indigenous foundational models reduce cost and latency barriers, encouraging domestic R&D and startup formation.

4.2 Enterprise digital transformation and GenAI adoption

- By 2030, two-thirds of large firms are expected to re-platform core processes (customer ops, risk, supply chain, finance) to AI-native architectures; GenAI copilots expand from pilots to production, increasing seat-based monetization.

4.3 Exported AI services

- Indian IT-services firms reposition toward AI engineering, model integration, guardrails, evaluation, and safety, converting traditional application modernization pipelines into AI-led transformation programs.

4.4 Sectoral catalysts

- Financial Services: fraud analytics, underwriting, copilots for relationship managers.

- Healthcare: imaging triage, clinical documentation, drug discovery services.

- Retail/CPG: demand forecasting, dynamic pricing, content generation.

- Manufacturing: predictive maintenance, quality control, autonomous cells.

- Agriculture: advisory, precision input management, weather-yield models.

- Public services: citizen service chatbots, grievance redressal, smart mobility, and DPI-linked analytics.

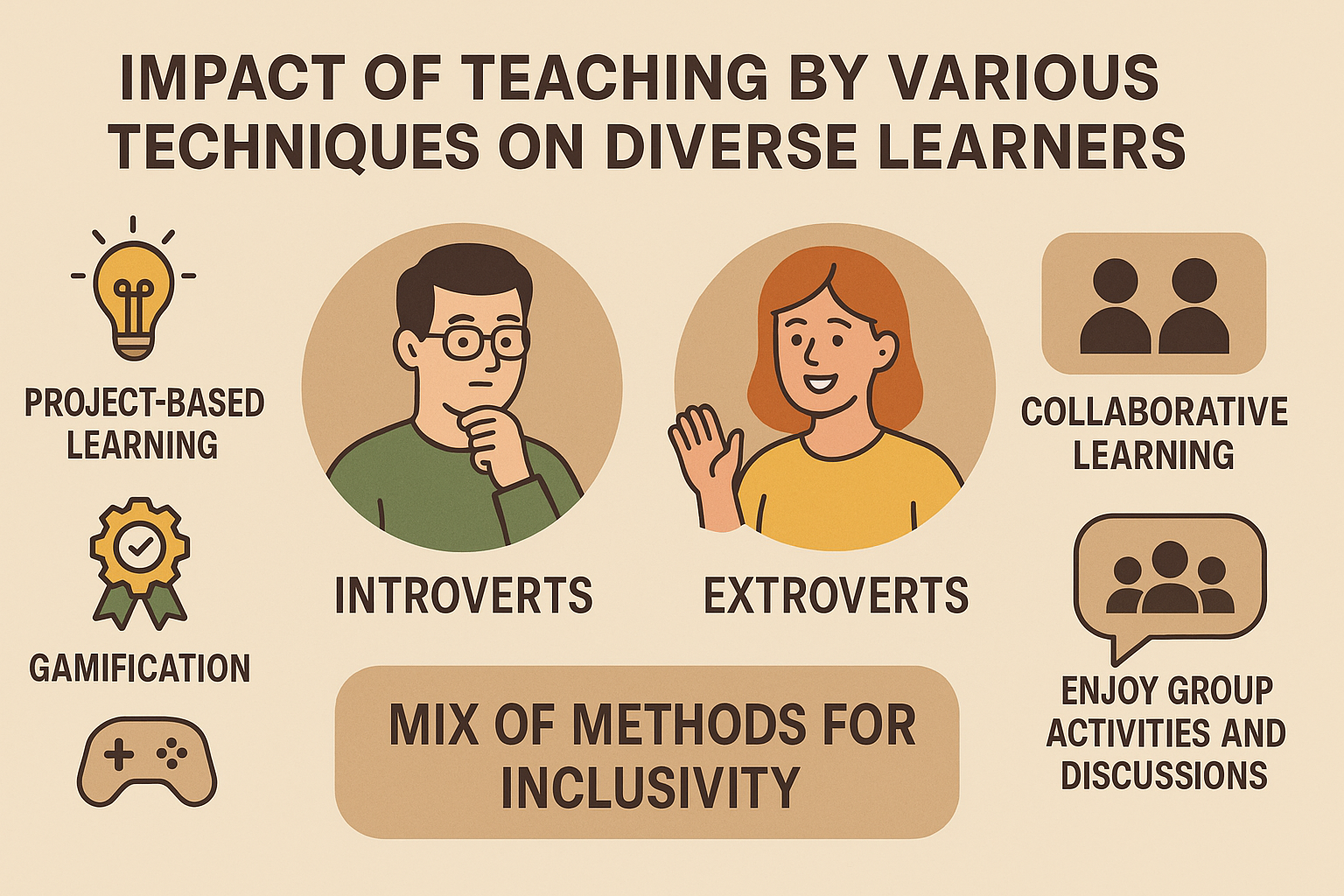

4.5 Talent and skilling

- India’s large STEM pipeline, plus accelerated AI upskilling in IT services, sustains delivery capacity; GenAI tooling compresses ramp-up time for developers and analysts.

5. Frictions and Risks

- Compute & data bottlenecks: Timely roll-out of public compute; access to high-quality multilingual datasets.

- Regulatory clarity & safety: Need for standards on model transparency, safety testing, and data protection.

- Enterprise change management: Scaling beyond pilots; ROI tracking; vendor lock-in.

- Labor transition: Reskilling for mid-level roles as automation expands; net new AI roles offset some displacement but require targeted programs.

6. Market Sizing Framework and Scenarios (2030)

We triangulate from 2024–2027 baselines, apply segment-specific growth assumptions, and incorporate supply-side constraints (compute, talent) and demand-side accelerants (policy, exports). Numbers below indicate direct market revenues in USD.

| Segment | 2024–25 Indicative Base | 2030 Base Case | 2030 Accelerated | 2030 Hub 2.0 |

| AI software/platforms (incl. GenAI) | $2.5–3.5B | $10–13B | $16–20B | $22–26B |

| AI-enabled IT/BPO & managed services | $3.5–4.5B | $12–15B | $18–22B | $24–28B |

| AI infrastructure services (cloud/data/compute) | $1.5–2.0B | $5–6B | $7–9B | $9–11B |

| Sector AI solutions (embedded/vertical) | $1.0–1.5B | $4–5B | $6–7B | $7–8B |

| Total | $8.5–11.5B | $28–35B | $45–55B | $60–70B |

Interpretation: The Base Case assumes steady policy execution and 25–30% CAGR through 2030; the Accelerated Case assumes faster compute rollout, strong enterprise productionization, and export upshift; the Hub 2.0 scenario layers in India becoming a preferred global AI engineering and safety-evaluation hub, plus rapid growth in domestic vertical AI.

7. GDP Contribution vs. Direct Revenue

Direct market revenue understates macro impact. AI-driven productivity, new products, and exported services could deliver hundreds of billions of incremental GDP contribution by 2030. The range depends on diffusion rate, capital deepening, and complementarities (cloud, 5G, IoT, robotics). India’s share of global AI value capture will be mediated by export intensity and domestic sector reforms (health, agriculture, manufacturing).

8. Regional and Ecosystem Dynamics

- AI Corridors & Data Cities: Clusters around Mumbai–Pune, NCR, Bengaluru, Hyderabad, Chennai, and emerging data-center hubs (Navi Mumbai, Noida, Chennai) attract talent and capital, improving ecosystem density.

- Startup pipeline: Foundation-model startups, domain copilots, and AI safety/tooling firms gain from compute credits and public-private sandboxes.

9. Policy Priorities (2025–2030)

- Compute at scale: Public-private GPU hubs; energy-efficient data centers; Indian accelerators/ASICs R&D.

- Open datasets & evaluation: High-quality, multilingual corpora; standardized safety and benchmarking suites.

- Skills at scale: National AI skilling missions mapped to micro-credentials; apprenticeship pathways in SMEs.

- SME diffusion: Tax credits, template playbooks, and shared services to move beyond large-enterprise adoption.

- Responsible AI: Risk-tiered obligations, impact assessments, and DPI-compatible privacy-preserving analytics.

10. Implications for Stakeholders

- Enterprises: Move from pilots to platform—create an AI platform team, data contracts, evaluation pipelines, and a portfolio of copilots tied to P&L outcomes.

- Startups: Target painkiller use cases with measurable ROI; leverage IndiaAI compute credits and DPI rails for scale.

- Investors: Favor picks-and-shovels (tooling, evaluation, safety), secure data moats, and sector-specific copilots.

- Government: Sequence compute + skills + safety; catalyze procurement for proven AI solutions in public services.

11. Methodology and Limitations

This work blends bottom-up segment growth assumptions with top-down constraints and cross-checks against public market studies. Estimates are directional and scenario-based—not forecasts. Uncertainties include global macro, regulatory shifts, and technology performance curves.

12. Conclusion

With coherent execution, India can translate its IT-services base, policy momentum, and digital public infrastructure into a globally significant AI economy by 2030. The span between $28–35B and $60–70B in direct market revenues reflects the strategic choices India makes now—on compute, data, skills, and responsible AI.

Appendix A: Sector Use Cases & KPIs (Selected)

- Banking: 20–40% reduction in fraud false positives; +5–10% cross-sell via next-best-action.

- Healthcare: 30–50% faster documentation; AI-triage sensitivity >95% on priority conditions.

- Manufacturing: 10–20% unplanned downtime reduction; 3–5% yield improvement.

- Retail: 2–4 ppt margin uplift from pricing/promo optimization.

- Agriculture: 5–10% yield gains; 10–15% input cost savings via precision advisory.

Appendix B: Scenario Triggers

- Accelerated Adoption: Public compute >=10k GPUs operational by 2026–27; enterprise AI seat penetration >25% by 2028.

Hub 2.0: India becomes a global center for model eval/safety, with export intensity >55% of AI revenues and strong vertical-solution exports.

Other Blogs

Rozgar Mela by PM Narendra Modi: A Strategic Tool for Youth Employment in India

Software Development and DevOpsBridging the Gap for Modern Application Delivery